How to Apply for Apple Card

Apple Card is a credit card offered by Apple and Goldman Sachs that offers daily cash back, in-app data about your purchases and spending habits, and other benefits, and you can use it directly from iPhone in the Wallet app. You’ll get a physical Apple Card too, which is crafted out of a fancy metal material, making the physical card somewhat similar in appearance to other notoriously high end credit cards like the AmEx Centurion or JP Morgan Reserve card. But unlike those other high-end credit cards, the Apple Card is much more broadly accessible and without the same requirements to obtain.

If you like to use credit cards for cash back and the convenience they offer, and you have an iPhone, applying for Apple Card may be something you’re interested in.

How to Apply & Sign Up for Apple Card from iPhone

Note that you must have an iPhone to be able to apply for the Apple Card:

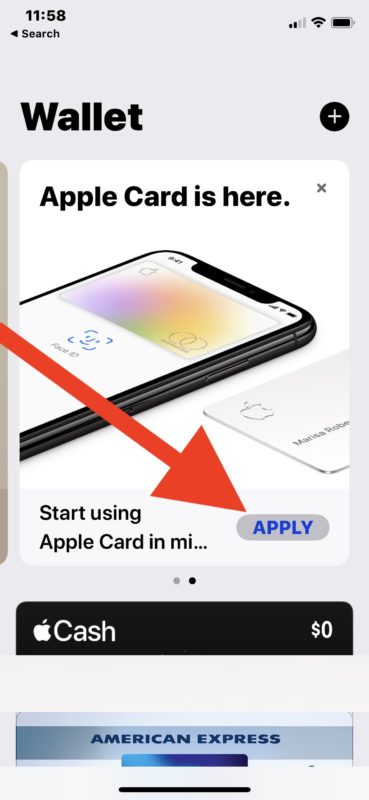

- Open the “Wallet” app on your iPhone

- Click on ‘Apply’ on the Apple Card promo, or click the “+” plus button to add an Apple Card

- Click continue and through the signup process

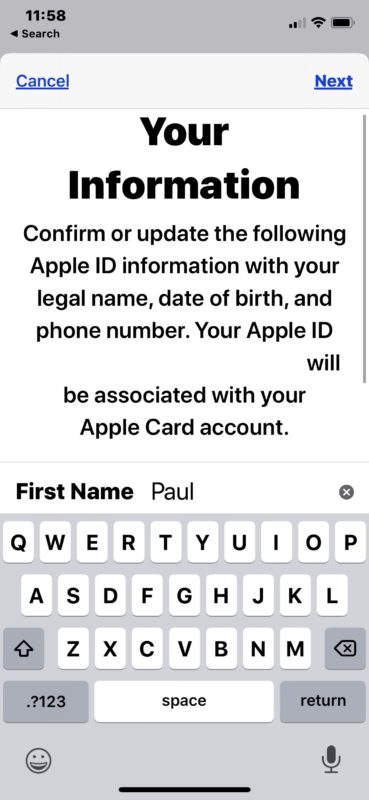

- Confirm your Apple ID, name, address, and other personal information as required by Apple Card

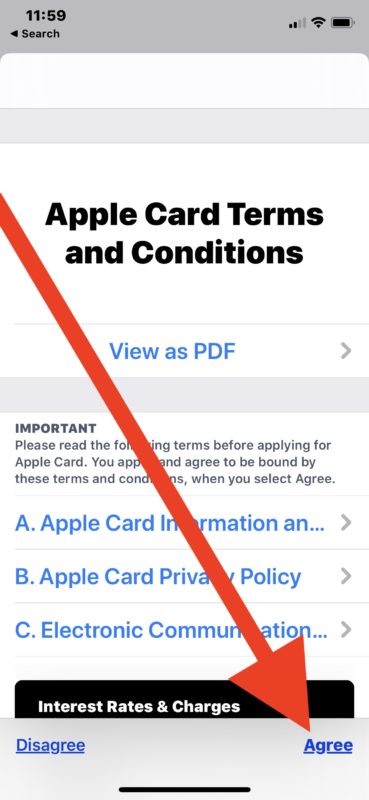

- Agree to the terms after reviewing interest rate and charges

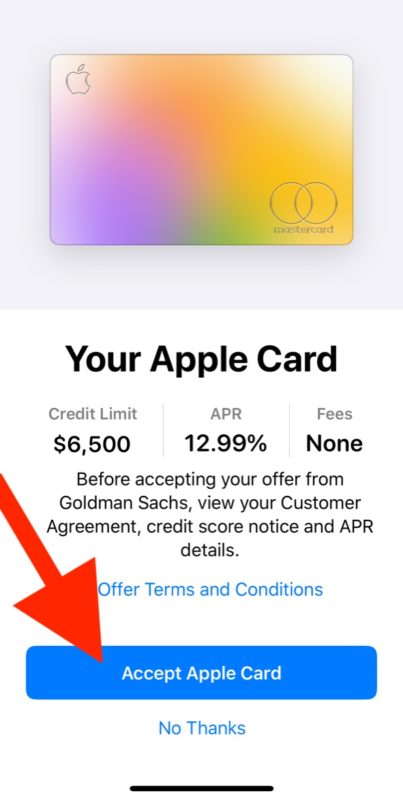

- You’ll either be immediately approved for Apple Card and shown your credit limit and details to which you can approve and accept, or asked to submit additional documentation like taking a photo of your ID

![]()

If you are granted immediate approval than you can use the Apple Card right away with your iPhone and Apple Pay. If you have to submit additional documentation there will be a delay until you’re either approved, or denied.

The credit limits and interest rates vary on the individual persons credit scores and other details, and there seems to be a large range of numbers for both. If you’re not happy with what is offered to you, you can always reject the card, or close it.

Like all other credit cards, Apple Card charges interest (and at varying rates depending on your credit), so it’s best to use the credit card responsibly. Paying the card balance off in full before any interest is accumulated is one way to do that.

After you’re signed up, managing your Apple Card is also done through the Wallet app, and you can also have a live chat with customer service if needed, or call a phone number of course too.

While you’re in the Wallet app, you might also find it worthwhile to add other credit cards to Apple Pay on the iPhone too.

Note that if you’ve never setup Apple Pay you will need to do that as well in order to apply for and use Apple Card.

Did you apply and sign up for Apple Card? Do you use the Apple Card and find it convenient? Share your thoughts in the comments below.

Like Margie, I too have excellent credit rating, mine is 794, and have no missed payments in like forever. I went thru the application and found the percentage rate for the card too high. So declined and will not get the card.

All credit cards tend to have really high interest rates in the USA, not sure how it is elsewhere. I think I read the “lowest” rate on Apple Card is around 12% which is still quite high, but that might be in line with other US credit cards.

Best to never carry a balance with a credit card to avoid the interest fees anyway… pay in full at each cycle and use it for convenience only.

Why would anyone want this credit card? The rates it offers are not even close to competitive. This is like a complete non-starter… I’m not certain who the target market is for this card…. overactive domestic consumer with next to no financial knowledge?

Robin

Nice, but what’s the percentage back on various classes of purchases? I already get from 1 to 3% back … and if card can’t compete, nothing there for me.

It’s 1% cash back when using the physical chip card, 2% when using apple pay and 3% if using apple pay AND shopping with apple and a few other associated merchants such as Uber or Walgreens.

Not everyone has fancy credit, some have poor credit. Does the Apple family offer say $100 limit for those with not so good credit or is this just for rich $100,000. folks that do not include us $10,000. people, just getting along and saving to finally get an iPhone due to the high price? Please report on the chance we have too.

Not available in Canada. You might want to mention that.

Not available anywhere outside the continental U.S., actually. But that has been well known for months now.

Why would Apple EVER choose Goldman Sachs as a business partner? I hope many of your customers will not apply for the Apple Card because of this alliance.

My concern is, is Apple Card likely to “Bite Me On the Arse” at a latter date in an unseen future date data breech Hacking of Apple’s software…

I’d like to know if anyone has successfully been able to apply and actually receive an Apple card. I have applied twice and have been denied. My credit score is 847, I have a mortgage and a HELOC. I am not behind on any of my debt obligations, nor do I have any negative public records. I have never fully utilized any of my credit lines. I have a decent after-tax income and live very comfortably, yet I am denied this card. This is very frustrating! I want to say keep your Damn card Apple!

Once again, another great tip. However, the statement “Note that you must have an iPhone to be able to apply for the Apple Card:” is false. The Apple Card application process can also be completed on an iPad in settings>wallet & apple pay. Note that the iPad is limited to using apple pay only on websites and in apps, so for iPad users who do not own an iphone and/or an apple watch, the physical titanium card will be the only way to pay with Apple Card at physical brick and mortar stores.